Southern Cross Gold

Southern Cross Gold set to become exciting new entrant onto ASX

Pre-IPO Offering

Mike Hudson was interviewed live from the company’s Nagambie core sheds about the overnight drilling announcement and the current exploration campaign. Watch the interview here.

Bonanza grades hit by Southern Cross prior to its ASX IPO

TSX listed Mawson Gold Ltd (TSX:MAW) has received its approval from the ASX to spin out its Australian assets onto the Australian market in early 2022 under the name of Southern Cross Gold.

The company is in the process of an in demand pre-IPO capital raise which will allow Southern Cross to take management control leading up to the IPO next year.

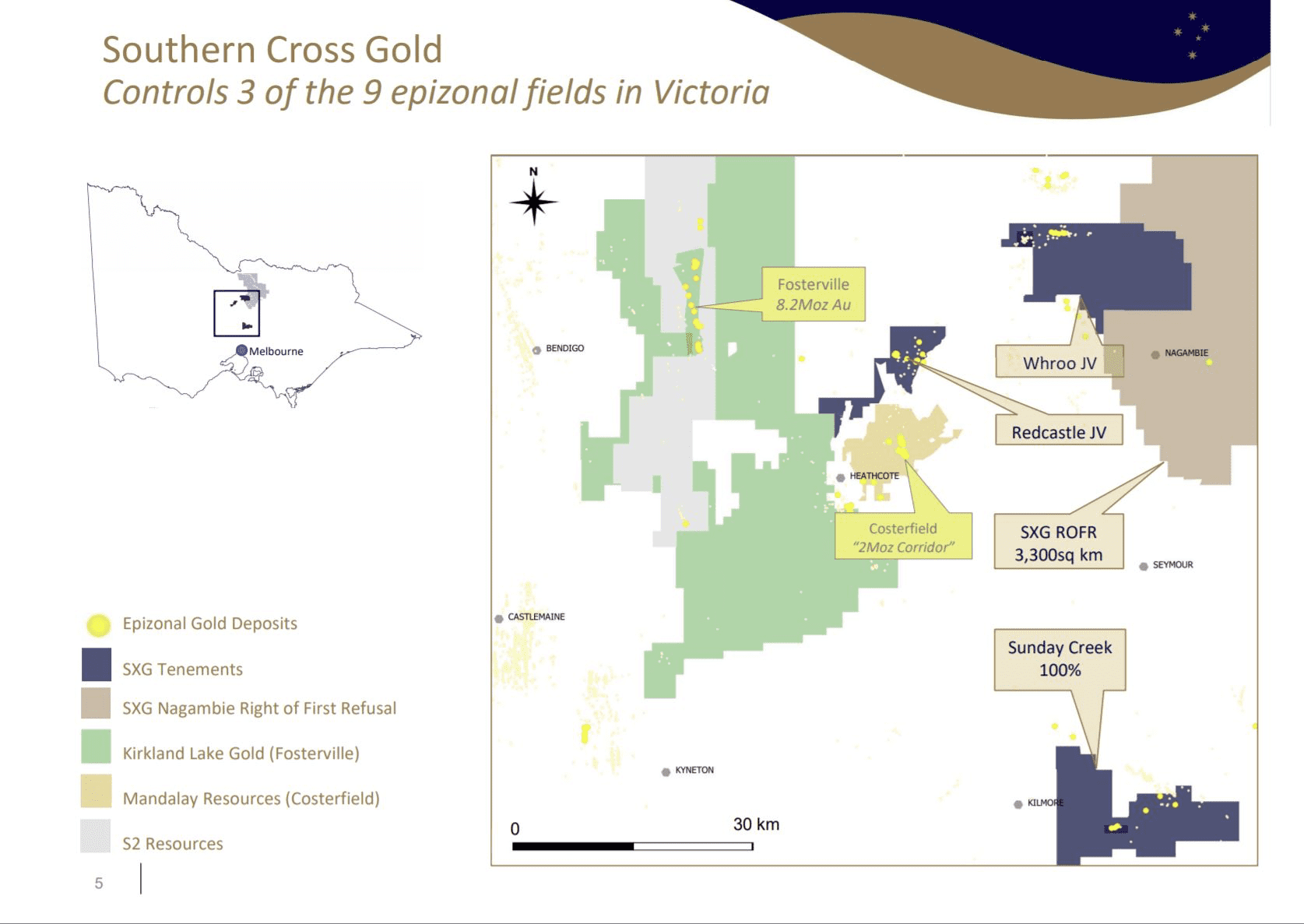

Central to the excitement of the listing will be how advanced Southern Cross’ three gold exploration properties in the Melbourne Zone of central Victoria are in the 100% owned Sunday Creek and Redcastle and Whroo where Southern Cross are working towards 70% JV ownership alongside Nagambie Resources Ltd (ASX:NAG).

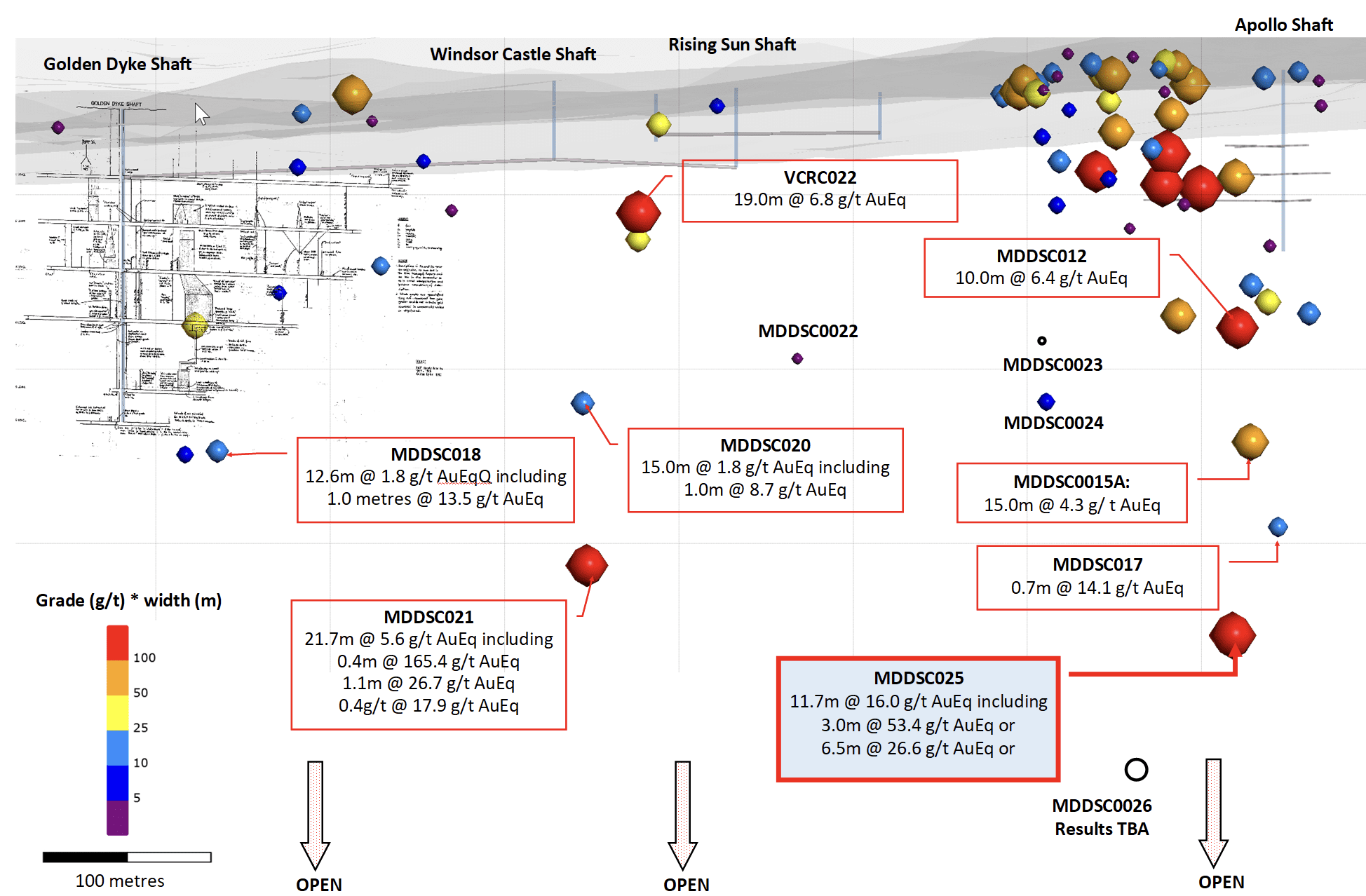

Hot on the tails of the ASX approval Southern Cross today announced its best drill results from over 6,400 metres of drilling at its Sunday Creek property, an attention grabbing 11.7 metres @ 16.0 g/t AuEq (12.4 g/t Au and 3.6% Sb) from 362.0 metres in hole MDDSC025, including:

3.0 metres @ 53.4 g/t AuEq from 364.0 metres and 0.5 metres @ 18.7 g/t AuEq (14.3 g/t Au and 4.4% Sb) from 370.8 metres;

This follows other previous drilling where solid grades and widths such were reported.

Michael Hudson, Executive Chairman, states: “Sunday Creek is one of the best discoveries to be made in the modern renaissance of the Victorian goldfields. With bolder and larger step-outs the project continues to deliver. Our deepest hole at the project to date has intersected the highest grades and widths we have seen. This is the eighth intersection exceeding 100 “grade (g/t) x width (m)” on the project. Mineralization remains open at depth and the system continues 10 kilometres to the east covering historic mines, without a single drill hole test.”

Southern Cross properties cover 471km2 at three of the nine historic high-grade epizonal goldfields in the Melbourne Zone that were prodigious producers of gold in the nineteenth century. Through a direct 10% ownership of Nagambie Resources Southern Cross also has a right of first refusal over an additional 3,300 km2 which stretches north up towards the border of NSW giving the company a huge amount of opportunity going forward.

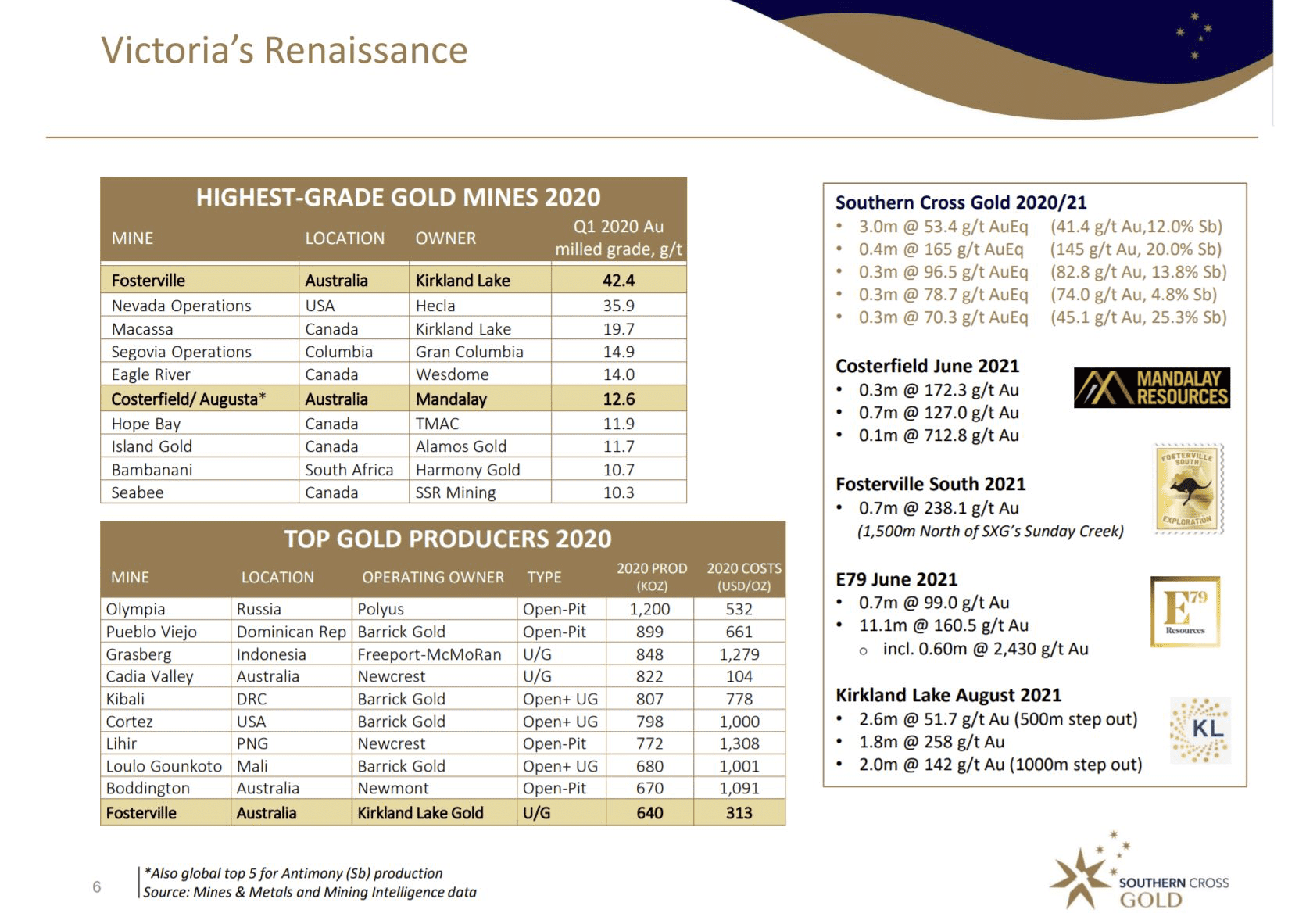

“Everyone knows about the Fosterville and Costerfield mines, but what they may not know is that in 2020, Fosterville was the highest grade gold mine in the world and Costerfield number six” says Michael Hudson, Founding Managing Director of Southern Cross Gold. “These two mines are within two of the remaining six epizonal goldfields in the state that we don’t control and are within a short drive to our properties. But they are also both owned by Canadian listed companies. Our hope is that we can find similar world class deposits as an Australian company owned by Australian shareholders.”

New, deeper life to historic goldfields

All three properties in SXG’s Victorian portfolio have long histories of gold production to relatively shallow depths.

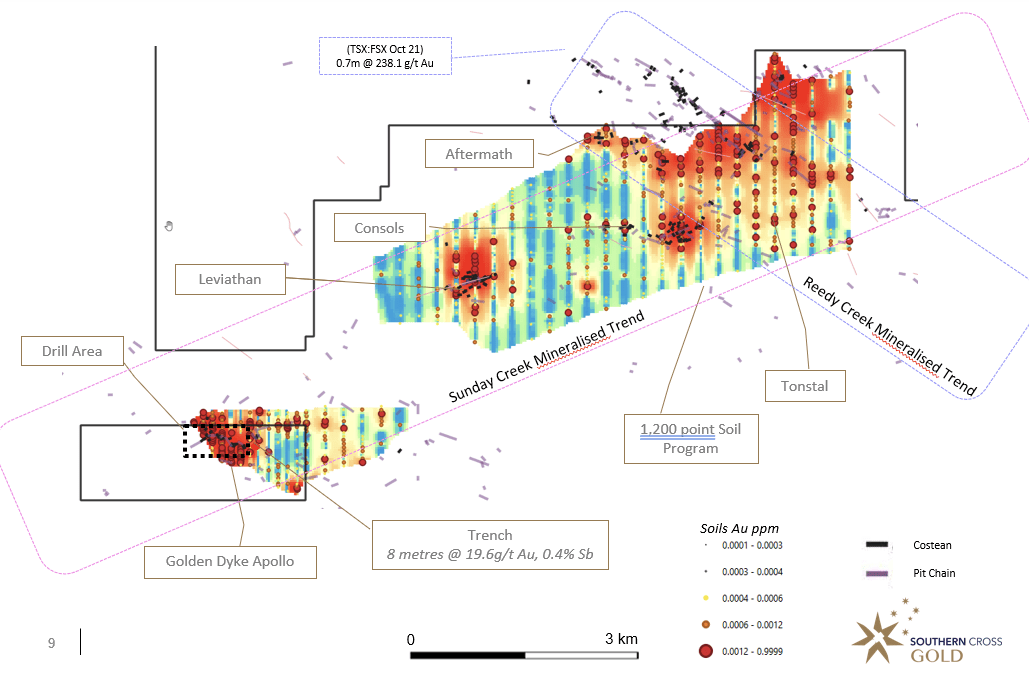

SXG’s current parent company, Mawson Gold, has already drilled 26 holes for nearly 6,500 metres beneath historic workings at the Sunday Creek property, a shallow orogenic (or epizonal) Fosterville-style deposit located 56 kilometres north of Melbourne and contained with 19,365 hectares of both granted and applied for exploration tenements. Historic gold mining between 1880-1920 occurred over a greater than 11-kilometre trend at Sunday Creek with total production being reported as 41,000oz gold at a grade of 33 g/t gold. Gold mineralization is hosted within, or proximal to, dykes with mineralization continuing along structures that extend into the sedimentary country rock.

Over 90% of 11km trend at Sunday Creek remains undrilled and previous workings in the area never went deeper than 100m. “We are looking for, and finding, Fosterville-style mineralisation at depth at Sunday Creek”, says geologist and Senior Technical Adviser Dr Nick Cook.

To back this up, Mawson has just released the results of its deepest drill hole at the Apollo Mine area at Sunday Creek which intersected 11.7 metres @ 16.0 g/t AuEq (12.4 g/t Au and 3.6% Sb) from 362.0 metres that included 3.0 metres @ 53.4 g/t AuEq (41.4 g/t Au and 12.0% Sb) from 364.0 metres.

Victoria has seen over $200m pumped into gold exploration in recent years but the region is dominated by Canadian listed companies. As its name and evocative logo suggest, Southern Cross is a locally run company aiming to have Australian investors participate directly in what has been termed “the modern renaissance of the Victorian goldfields.”

Results not a one-off

This is only weeks after releasing an equally impressive 21.7 metres @ 5.6 g/t AuEq (4.7 g/t Au and 1.0% Sb) from 274.7 metres which included 0.4 metres @ 165.4 g/t AuEq (145.5 g/t Au and 20.0% Sb) from 277.0 metres 380 metres to the west. These recent results are two of eight intersections at Sunday Creek that have exceeded 100g per metre at the property.

The story of historic shallow, high grade production is similar at both the Redcastle and Whroo properties where Mawson has been earning it’s up-to 70% ownership in the JV with Nagambie Resources that Southern Cross will take over from Mawson after its pre-IPO raise.

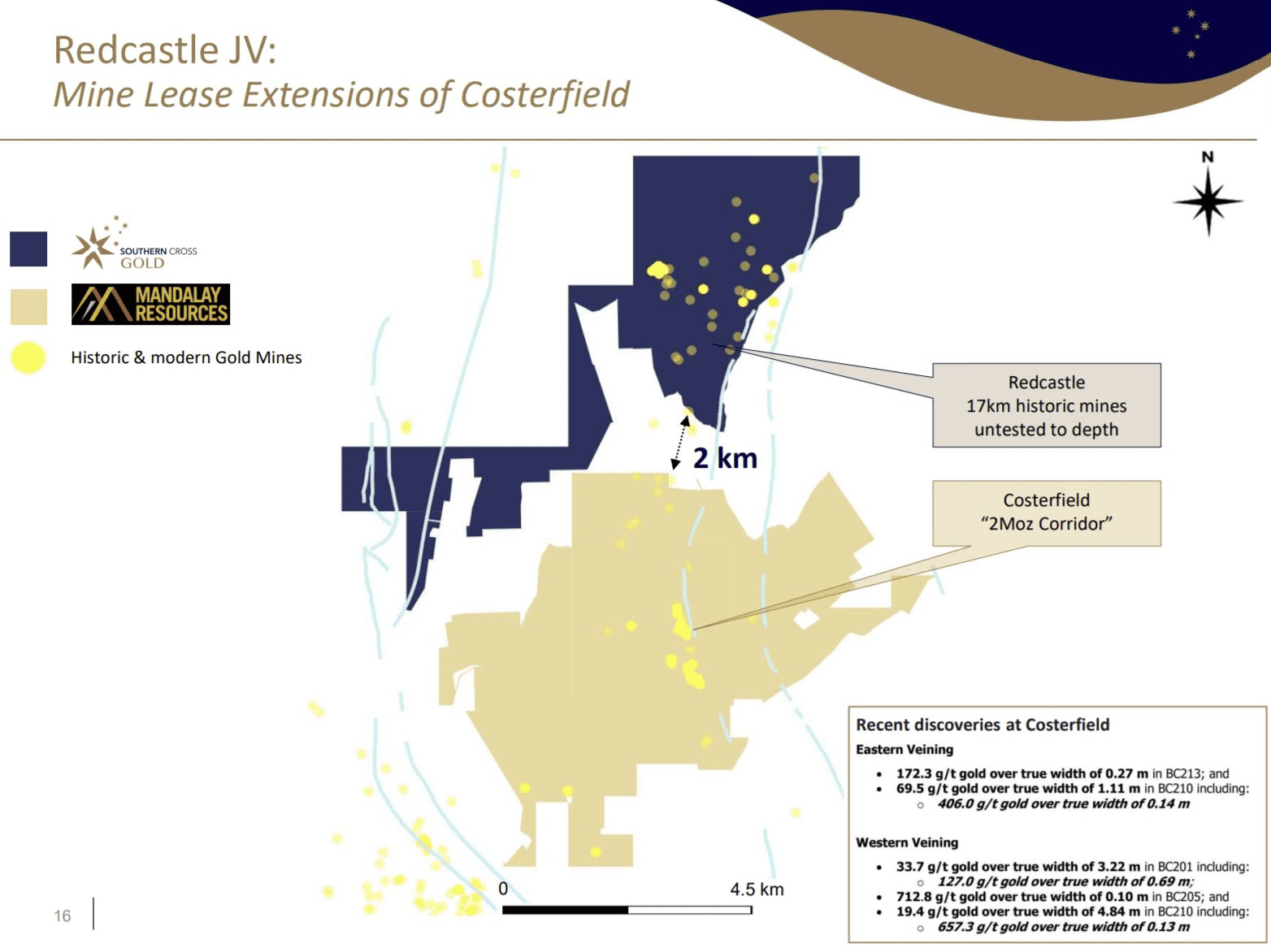

Redcastle is an exciting prospect as it is located just two kilometres along strike from Mandalay Resources’ Costerfield mine exploration tenements on a parallel north-south mineralised structure and 24 kilometres east of Kirkland Lake Gold’s Fosterville mine. The property contains a total 17kms of veins that are untested to depth by modern techniques. Mawson has already undertaken over 2,700 metres of drilling, geophysics surveys and flown LiDAR over the property that showed over 40,000 historic workings.

Southern Cross will also continue the drill program that Mawson recently commenced at the Whroo property furthest north of the three properties near the historic town of Rushworth. Over the last 10 months at Whroo, Mawson has completed a detailed LiDAR survey which extended the previously mapped Whroo historic mining field from 10 kilometres strike to 14 kilometres. In November Mawson commenced drilling two deep diamond holes under the Balaclava open pit, which extracted 23,600 oz gold during the 1800s. In the only test of gold mineralisation to moderate depth (110 metres vertically) along the entire Whroo goldfield. These results are due shortly.

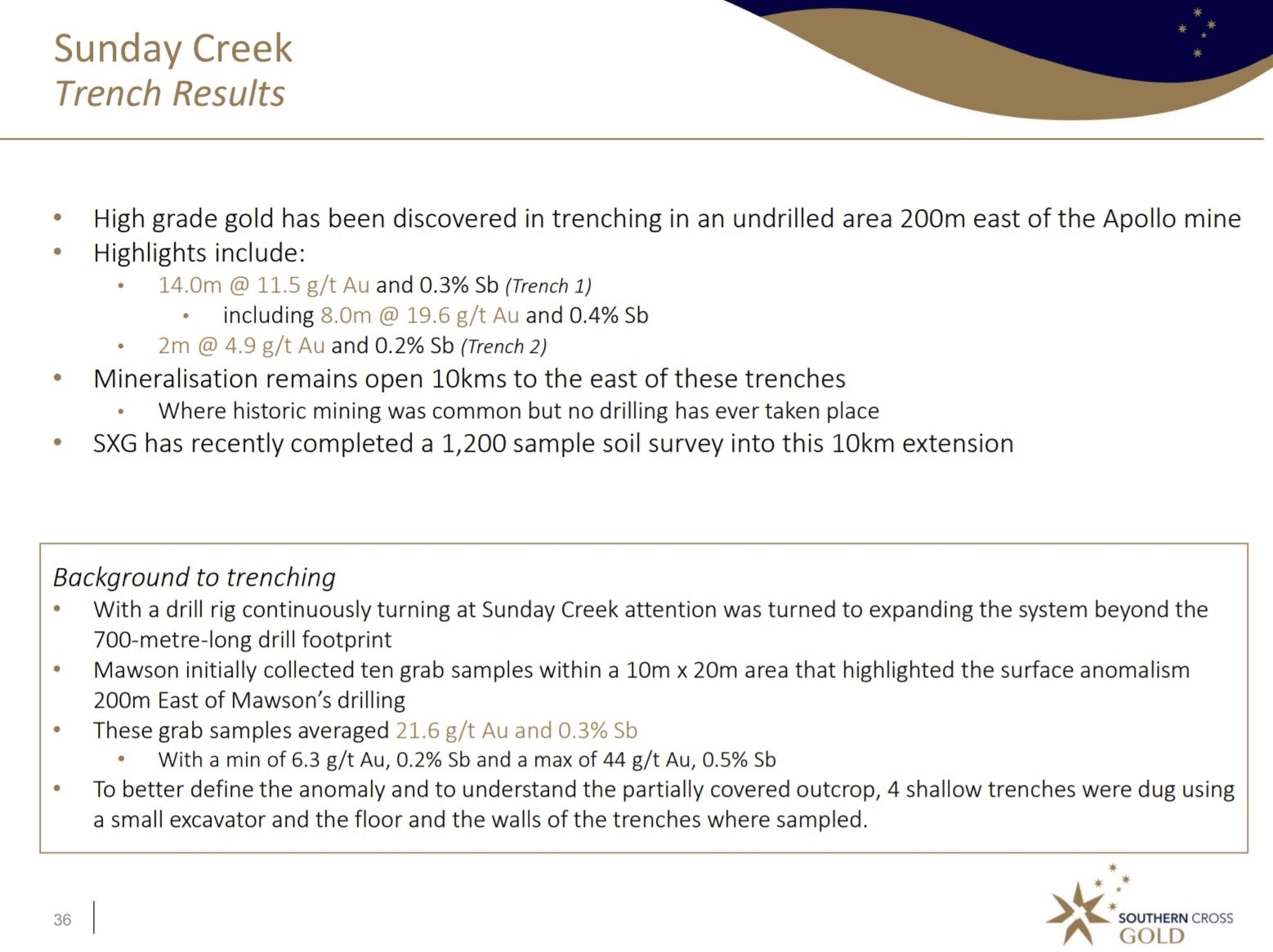

Surface gold

The story is not just the gold underneath the previously unexplored grounds of central Victoria. SXG has conducted extensive surface trenching and soil sampling at Sunday Creek. Highlights of the trenching included 8.0 metres at 19.6 g/t Au within 14.0 metres at 11.5 g/t Au.

Southern Cross has recently completed a 1,200 sample soil survey into the 10km extension with results awaited.

New company but experienced team

The management and board of Southern Cross Gold are certainly no strangers to exploration having a cumulative track record of many deposits found and sold over many decades amongst them most recently having found 1Moz over the last 4 years in Finland with Mawson Gold and looking to do it again in Victoria.

The Non-Executive Chair is the well known industry veteran Tom Eadie who was previously Executive General Manager – Exploration and Technology at Pasminco and well as the founding Chairman of Syrah Resources.

Michael Hudson, SXG MD and Executive Chairman of Mawson Gold, grew up and went to school in the shadow of the Sunday Creek project. “It is like coming home for me” says Hudson, a University of Melbourne geology graduate from the early 1990’s. “I am a Victorian boy, raising my family in Melbourne, but up to the start of the pandemic, I was always on a plane heading up to the Northern Hemisphere exploring in places as far flung as Pakistan, Peru and Finland. Now I can drive up to site in the morning and be back home for dinner that evening. It’s fantastic.”

Nearly every other member of the SXG team live within a short drive of the projects. “This has been a key asset over the past 18 months” says Hudson. “The Victorian Government deemed exploration an essential service during the recent lockdowns so Mawson never stopped work on the properties. The team working under the Mawson name are all coming over to Southern Cross so we lose none of the deep knowledge and understanding of the rocks and structures we have built up over the past two years.” The team responsible for leading the Australian projects have drilled over 90,000 metres in the parent Mawson’s Finland gold project where they delivered grades of 6 metres @ 617 g/t Au including Finland’s best ever gold hole of 1 metre at 3,540 g/t Au.

Positioning itself for a successful future

Manager for Corporate Development at Southern Cross, Nicholas Mead, states that the company is in a unique position for a new company coming onto the ASX. “We are not a start up coming to investors with a vague strategy of looking for gold. We come to the market with a ready-made board and management team who have worked with each other for decades in some instances, with a proven track record of ore finders and with just over 9,000m already drilled in Australia with proven high grade intercepts at locations that are famous for their previous gold production.” “The management structure is in place, the geological team is in place, our geological proof of concept is in place and the capital structure is tight and well constructed.”

There will be no time lost post the proposed ASX listing as drilling, soil sampling and geophysics are all continuing into 2022. Southern Cross Gold could well be one of the new stars to shine brightly on the Australian market.

Pre IPO opportunity

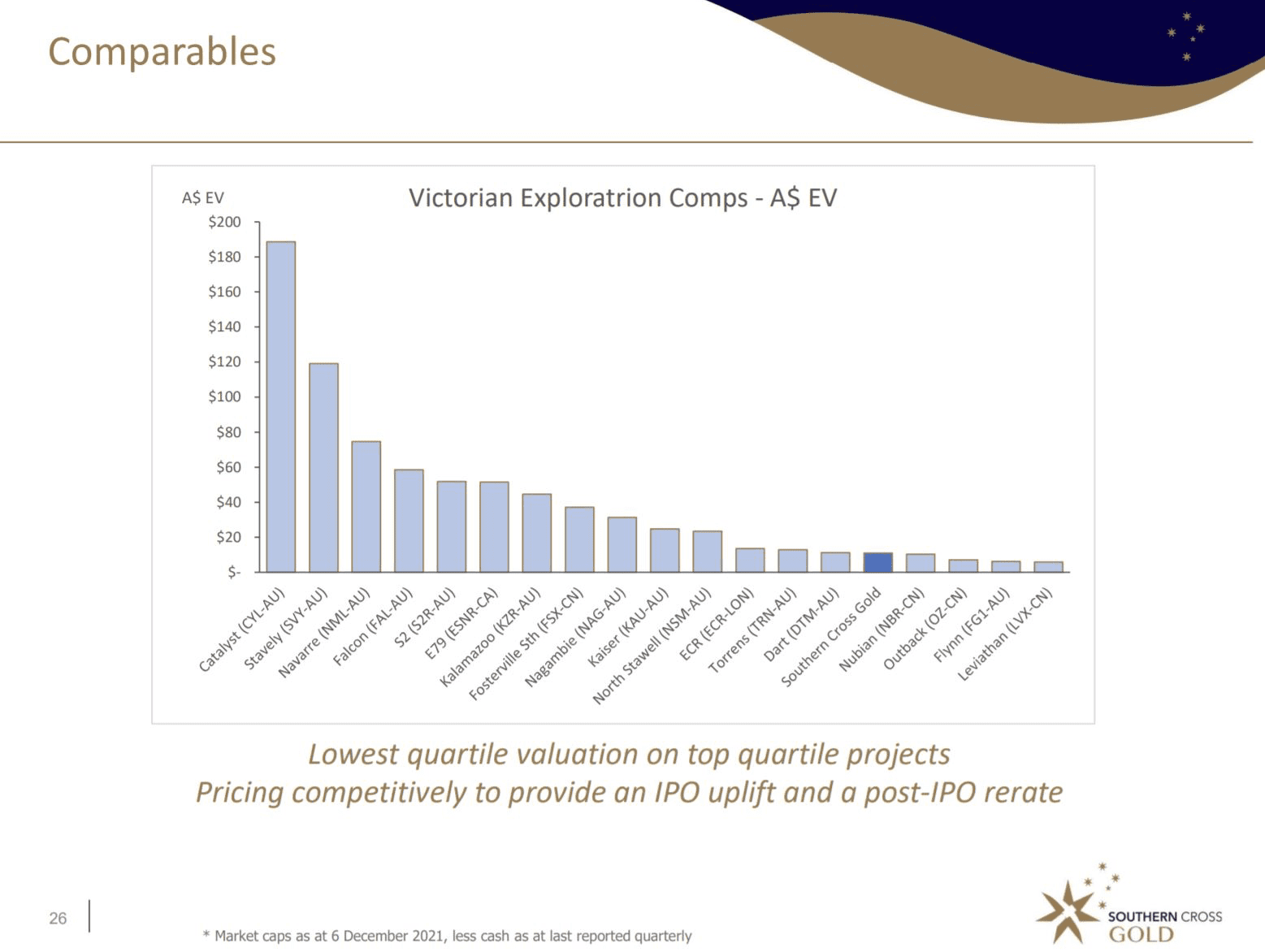

Southern Cross this week opened their first and only pre IPO raise where $2.5m will continue their drilling campaign and take them through to a proposed March IPO. At an EV of $15m which includes the 10% holding in Nagambie the company is are aiming to offer a top quartile asset at lowest quartile valuation to support post IPO success.

Register your interest

For more information on Southern Cross Gold, contact Sean Sandilands on 0412 166 471 email ssandilands@nullpulsemarkets.com.

By subscribing, you agree to receive information from Alpha Capital Australasia. We use Google reCAPTCHA to combat spam and respect your right to unsubscribe. Your personal information will be handled in accordance with our privacy policy.